What Does Ocwen Loan Servicing Do If A Mortgagor Dies

Today, nosotros're going to tell you story nearly good vs. evil, right vs. wrong. The chief graphic symbol in the tale is Riad Ghosheh who owns a home that Ocwen Loan Servicing LLC and PHH Mortgage Services tried to steal. They're the bad guys.

How bad?

As of this year, more than 11,000 complaints against Ocwen had been lodged with the Consumer Fiscal Protection Bureau (CFPB). PHH, which Ocwen acquired in 2018, has been tagged 781 times. Ocwen, a company we've fought and written well-nigh many times, is truly amid the worst of the bad actors that populate the mortgage servicing manufacture. It won't come up as a surprise that the company no longer operates under the Ocwen name. They decided to hibernate behind PHH's relatively clean reputation. But believe u.s., Ocwen's back there pulling the strings.

Those are the bad guys. Who are the good guys?

Well u.s., of course, the DannLaw legal team. When Riad learned that Ocwen/PHH was about to steal his domicile he contacted us. Here'southward a spoiler alarm: nosotros saved his firm. On October 30, Federal District Court Approximate Mark Norris issued a temporary restraining order that stopped the bad guys from moving forrad with a foreclosure that was scheduled for Nov 1. In the wake of Judge Norris' ruling, Ocwen/PHH has decided to arrest its effort to swipe Riad's residence. You can read Judge Norris' order here: tnwd-2_2019-cv-02710-00015 (1)

Talk most riding to the rescue just in the nick of time…

Merely the saga doesn't stop there. Simply saving Riad'southward house didn't seem like justice to him or us. Ocwen/PHH had put him through a horrible ordeal. They broke the law—in fact, they broke a agglomeration of them. Then we're using those laws, in detail the Real Estate Sales Practices Act (RESPA) to hold Ocwen/PHH answerable and make them pay for nigh wrecking Riad'southward finances and disrupting his life. Y'all can read the complaint we filed against the companies in Federal Commune Court for the Western District of Tennessee hither: Ghosheh Riad 2019 ten xviii TS Complaint

Truth be told, we've helped hundreds of people similar Riad over the years. Merely his story is both peculiarly compelling and infuriating, so we thought we'd share it, both equally a cautionary tale and to illustrate the strategies we use to fight giant banks and mortgage servicers—and WIN.

Here'due south our story…

Riad Ghosheh, who is legally deaf and partially blind, owns a abode in Cordova, Tennessee, a community just e of Memphis. Earlier this year, Riad went to Israel for an extended menstruum of time to have care of family unit business. Earlier leaving he asked his son to make the mortgage payments on the home and gave him the coin to exercise so.

You tin probably approximate what happened next: his son didn't make the payments. Riad returned to the United States and learned that his loan had gone into default. Needless to say, this was not the homecoming gift he expected.

In order to stop the home from going into foreclosure, Riad filed for Chapter 13 bankruptcy on June three, 2019. As we've noted in our blogs and on our website, filing Chapter 13 immediately brings foreclosure actions to a expressionless finish.

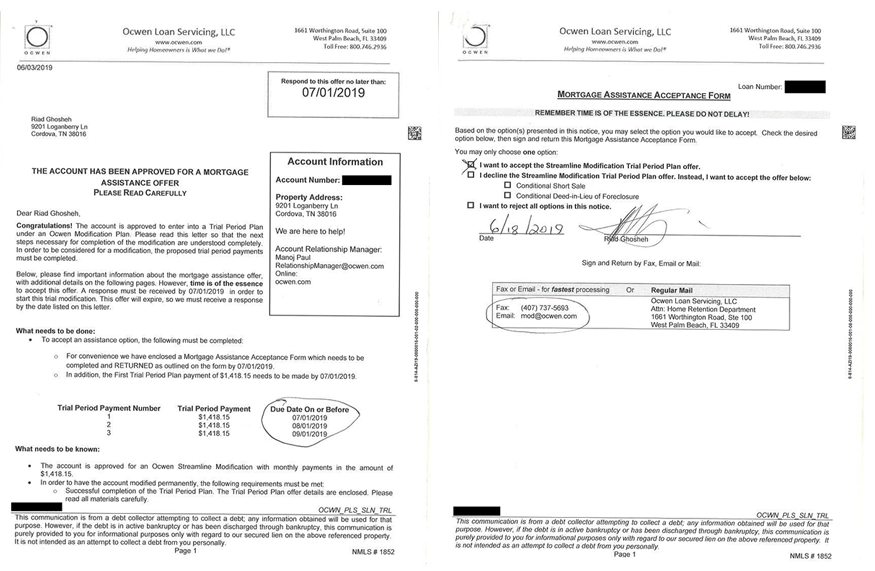

On or about the same day, Riad received a "Streamline Modification Trial Period Programme" (TPP) from Ocwen his loan servicer. Loan modification plans similar this are designed to requite homeowners the opportunity to prove they tin make their mortgage payments and resolve arrearages. They are likewise supposed to stop foreclosures. Annotation the utilize of the word "supposed." This volition be of import in just a scrap.

If he accepted the proposed TPP, Riad would exist required to make 3 payments of $1,418.15 starting time July ane. If he made the iii payments on time, the company would offer him a permanent loan modification programme. Riad signed the TPP on June eighteen, 2019, and mailed it to Ocwen the same day.

Because he knew he could beget to make the payments chosen for in the TPP and because the agreement was supposed to forbid Ocwen from foreclosing on his home, Riad allowed his bankruptcy petition to be dismissed. Afterwards all, his primary reason for filing was to save his home from foreclosure—a threat he supposedly no longer faced.

At that place'due south that word once more.

On June 24, Riad, as required by the TPP, made the July payment of $1,418.fifteen. Records prove Ocwen received the payment on June 28. He made the August payment on July 24 and the September payment on August 26. Three payments required. 3 payments made—early on.

Then far so expert, right?

Look, we told yous this was a story of good vs. evil, not a fairy tale. Things were far from good.

Here's what happened to the iii payments:

Ocwen kept the July payment but never applied it to Riad's loan;

On September 22, PHH, which had taken over the loan, sent the August payment back forth with a letter notifying Riad that he had violated the terms of the TPP;

The September payment, which was made nearly a calendar month before PHH sent back the August payment, is MIA. No one at Ocwen/PHH can notice information technology.

Riad was, to say the least, alarmed by these events, so he asked the person who held his power of attorney to contact the defalcation lawyer who had filed the Chapter thirteen petition on his behalf earlier in the twelvemonth.

This was a skillful call on Riad's role considering the bankruptcy attorney was the person who notified him that his firm was slated to be sold out from under him on November one. Ocwen/PHH had never contacted him or his counsel. The lawyer but knew the sale was about to accept place because he saw information technology advertised in the newspaper. It appears the fine folks at Ocwen/PHH who forgot to apply Riad's July payment to his mortgage so forgot to notify him that they were most to steal his home did call up to advertise the attempted theft in the paper.

At this signal, put yourself in Riad's place. You trusted your child to brand your house payments. He didn't.

You trusted your mortgage servicer to play by the rules and honor the terms of a mortgage modification program they offered you. They didn't.

Yous assumed that Ocwen/PHH would abide past the laws that govern the mortgage servicing industry. Of grade they didn't. Abiding past the police force is not part of their business model.

And equally a result of information technology all, you lot came inside days of becoming homeless—even though you did everything you lot were supposed to do.

And Riad, like thousands of other people who have been victimized by Ocwen, would have been homeless had he non contacted the DannLaw team.

As we mentioned above, nosotros've already saved Riad'south habitation. Now we're suing Ocwen/PHH in Federal Courtroom to make them pay for the emotional and physical distress their sordid behavior acquired, for dissentious Riad's credit, and for violating both RESPA and Fair Debt Collection Practices Act (FDCPA). Our filing alleges that Ocwen/PHH did the following:

Count One: RESPA Violations

Count Two: Breach of Contract

Count Iii: Promissory Estoppel (OK, we know you don't know what that is, and the caption is really long and complicated, just accept our word for it, Ocwen/PHH did it.)

Count Four: Conversion

Count Five: Unjust Enrichment (This one is easy to understand, information technology basically means Ocwen/PHH stole Riad's cash.)

Count Six: Violations of the FDCPA

The all-time affair is, Riad doesn't have to pay us to wage this battle on his behalf. If nosotros win the case, Ocwen/PHH will be required to pay our fees and we will receive a small percent of whatsoever damages the court awards.

And the damages part is no fairytale—nosotros've won significant financial awards for people like Riad numerous times in courts across the U.S.

That's our story. We'll let you know how it ends. Simply in the concurrently, if you lot or someone you lot know is facing foreclosure or is beingness driveling past a bank or mortgage servicer, don't exist a victim. Fight back like Riad, by contacting the experienced foreclosure defense attorneys at DannLaw. You can reach united states past calling the office near you or by completing the form on our Contact page.

Nosotros'll exist happy to schedule a no-cost consultation, provide you lot with sound legal communication, and aid yous relieve your dwelling and win the financial settlement you lot deserve.

What Does Ocwen Loan Servicing Do If A Mortgagor Dies,

Source: https://dannlaw.com/a-tale-of-good-vs-evil-we-stopped-ocwen-phh-from-stealing-riad-ghoshehs-home-now-were-going-to-make-the-companies-pay/

Posted by: cameronlacent.blogspot.com

0 Response to "What Does Ocwen Loan Servicing Do If A Mortgagor Dies"

Post a Comment